Filter By:

OCA’s 2025 Open Enrollment Key Communications/Deadlines

Open Enrollment Key Communications/Deadlines As we approach the 2025 Open Enrollment period…

Read More

June 2023 Product & Service Enhancement Updates

OCA's New Product & Service Enhancements Updates We are excited to announce that we have launched…

Read More

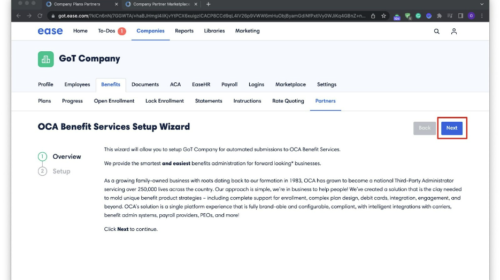

OCA & Ease Partnership

OCA is excited to announce it's partnership with Ease as of September 1, 2022. The Ease/OCA partnership…

Read More

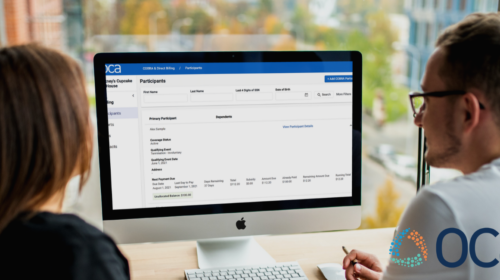

New Employer Invoicing Enhancements

OCA is very excited to announce many new client enhancements and service offerings this year. Today,…

Read More

COBRA Enhancements

OCA is excited to announce significant enhancements to our COBRA administration! These enhancements…

Read More

Horizon BCBS/ClaimsExpress

An Important Notification Regarding Horizon BCBS Participants Utilizing OCA's ClaimsExpress Service It…

Read More

An Important Notification Regarding Horizon BCBS Participants Utilizing OCA's ClaimsExpress Service

It has been brought to OCA’s attention that Horizon BCBS has automatically enabled an extra security feature on the Horizon BCBS member portal. The automatically enabled 2-factor authentication security setting is causing disruption to the ClaimsExpress service. This process, unfortunately, is breaking credential connections and we are no longer receiving claim data for processing.

In order to correct this connection, the 2-factor authentication will need to be disabled on the Horizon portal. Once completed, the connection with ClaimsExpress will need to be reestablished through the myOCA portal’s ClaimsExpress section.

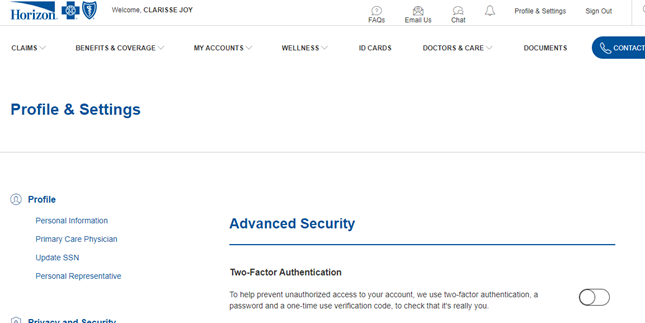

To remove the Advanced Security under Horizon:

- Go to profile and settings

- Go to advanced security

- Turn the MFA toggle off

See Screenshot example below:

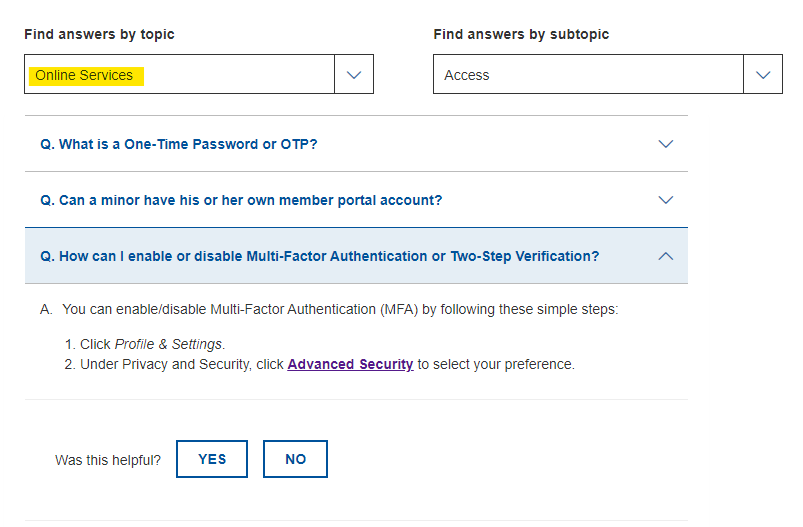

If you do not have this option through the profile settings, you may search through the FAQs to find the hidden Advanced Security, as seen in the screenshot below.

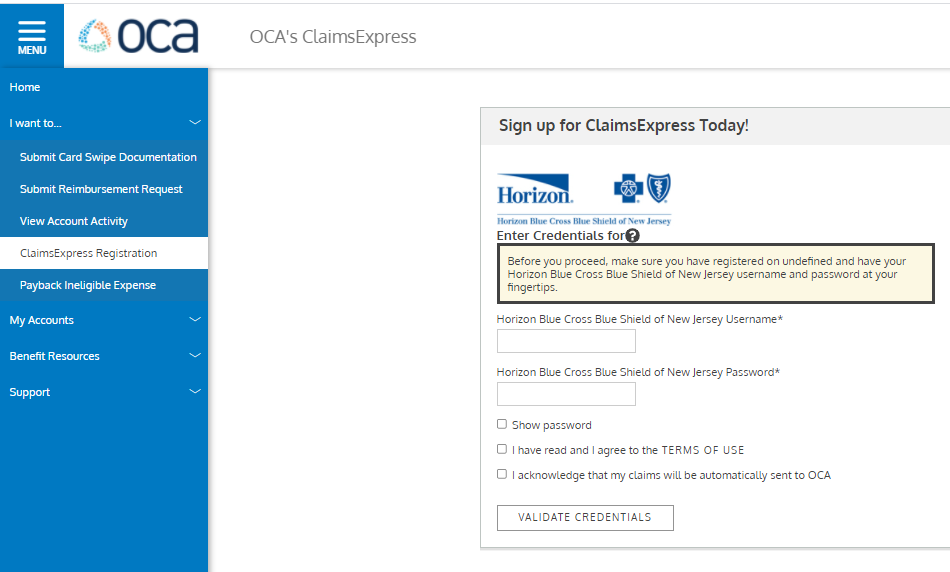

Once you have updated your Horizon BCBS settings, please log into your myOCA portal and update your Horizon BCBS login information as shown below.