Health Savings Account (HSA)

With nearly 25 million HSAs in the market and an 18% compounded annual growth rate, HSAs continue an impressive growth trajectory. Simplify the administration of your employee benefits by offering health savings accounts.

How does an HSA work?

As employers and consumers continue to face cost pressures and adopt high deductible health plans, HSAs have quickly become the primary savings and spending vehicle that consumers use to manage their out-of-pocket healthcare costs. With nearly 25 million HSAs in the market and an 18% compounded annual growth rate, HSAs continue an impressive growth trajectory.

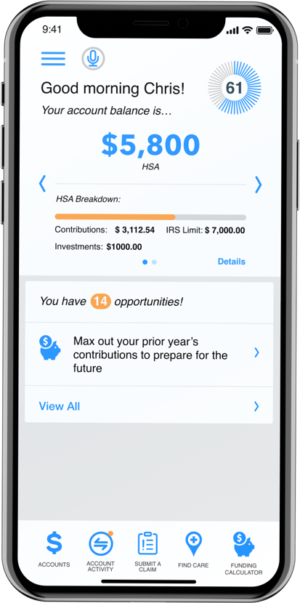

A truly integrated HSA experience that provides the consumer with a personalized approach using the right tools, support, and guidance.

Simplified Experience

We remove complexity and simplify decision-making by connecting health and wealth resources in one intuitive, easy-to-navigate experience

Personalized Guidance

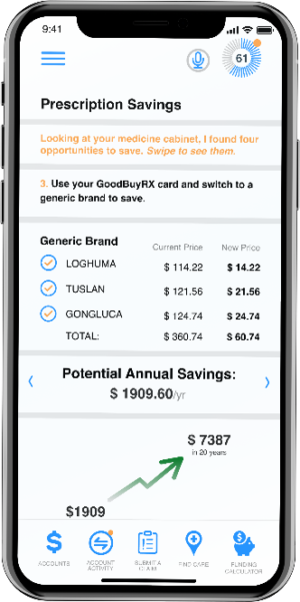

We use data-driven insights and innovative AI technology to deliver truly personalized guidance – taking the guesswork out of healthcare spending and saving decisions

Measurable Savings

We empower people to become better stewards of their healthcare dollars – helping people save more on healthcare, and helping employers bend medical trend

We Deliver A Smarter HSA Account Experience

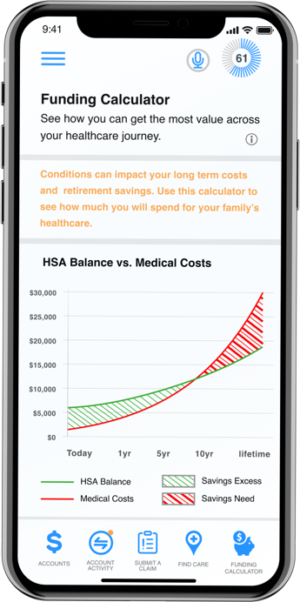

Using Investments to Grow HSA Dollars

One of the key benefits of an HSA is the ability for you as the account holder to invest the dollars you contribute, potentially growing the value of your account over time. In addition to the benefit of having more dollars to pay for healthcare costs in the future, it may also be a great option for retirement savings either in place of or in addition to an IRA or 401(k).

Learn MoreHSA Advance Funding

Now employers can provide a peace of mind to employees who want to adopt an HSA, but worry about the funds to cover out-of-pocket expenses. HSA Advance offers a better way to cover your employee’s healthcare costs! HSA Advance allows employers to offer their employees an advance on expected HSA payroll contributions. Employees can borrow from future contributions if they need to access funds beyond their current HSA balance.

Learn More

Health Savings Account FAQs

How can the employer and/or employee make HSA contributions?

Employer Funds Contributions: Through OCA’s secure portal, employers can then link up their employer bank account for OCA to withdraw the total contributions and allocate them accordingly into each of the employee’s HSA accounts.

External Funding through Payroll Provider: Your payroll provider will need the employee’s HSA account number. This information can be found by running the “HSA Account Details Report“ under the employer reports.

Employee Contributes Directly: Regardless of the employer making contributions or not, employees can fund money into their HSA account by logging into their online account. The attached guide will walk them through the “making a contribution” process

Helpful HSA Investment Tips

Minimum Balance is Required: With an HSA account balance over $1,000, you can establish an investment account. Any funds above this threshold can be invested in this account.

Investments Are Self-Directed: You control which mutual funds to invest in.

Industry Leading Investment Solution: Devenir is the advisor for the HSA investments, they have been a leader in HSA investments since they were first introduced.

Online Account Management: You can manage your investments online via your HSA account

Is an individual enrolled/entitled to Medicare HSA eligible?

An individual who is entitled to Medicare Is not HSA-Eligible. There’s more to it though. An individual can become entitled to Medicare benefits for three reasons: age, disability, or end-stage renal disease (ESRD). Entitlement to Medicare Part A is automatic for some individuals (i.e., a separate application is not required) because they have already applied for and are receiving Social Security or Railroad Retirement Act benefits. Other individuals must file an application in order to become entitled to Part A benefits. Note that mere eligibility for Medicare benefits (without enrollment) will not disqualify an individual from HSA eligibility.

The terms “eligible” and “entitled” are not synonymous under the Medicare regulations.* To be entitled to Medicare, an individual generally must be both eligible and enrolled. Medicare enrollment is automatic for some individuals (e.g., individuals who are receiving Social Security benefits); they simultaneously become eligible, enrolled, and entitled. Other individuals are eligible for Medicare but must file an application in order to be entitled to benefits (e.g., working individuals beyond age 65 who are eligible to receive Social Security benefits but who have not applied for them). For HSA purposes, Code §223(b)(7) states that an individual’s contribution limit becomes zero “for the first month such individual is entitled to benefits” under Medicare. IRS Notice 2004-50 and IRS Notice 2008-59 clarify that mere eligibility for Medicare does not make an individual ineligible to contribute to an HSA and that a Medicare-eligible individual who is not actually enrolled in Medicare Part A, Part B, Part D, or any other Medicare benefit may contribute to an HSA until the month that he or she is enrolled in Medicare.

In what ways can account holders contribute in the HSA?

You can make either pre-tax contributions, post-tax contributions, or a combination, as long as the combined total does not exceed IRS annual limits. Pre-tax contributions are made through payroll deduction. Post-tax contributions are made by depositing directly into to your HSA account. Post-tax contributions for a given year can be made up until the due date of your tax return for that year.

Can I contribute to my HSA while on COBRA?

The answer depends on the type of insurance coverage you have while on COBRA. As long as you are enrolled in a qualified high deductible health plan, you can make contributions. That is one of the stipulations for opening and contributing to an HSA.