Health Reimbursement Arrangement (HRA)

HRAs can vary greatly in design but are developed basically for the same purpose; to reimburse employees tax-free for expenses not covered by the employer’s health plan.

How does an HRA work?

Our HRA solution provides flexibility for employers to create a benefit design that meets their company goals and objectives! Health Reimbursement Arrangements (HRAs) are tax-advantaged accounts that are funded with employer dollars to pay employee expenses not covered by their health plan. The employer outlines what expenses will be covered in the HRA. For example, an HRA could pay all eligible medical deductible expenses or the HRA could be limited to cover only dental or vision expenses. Although an HRA can have an option to carry forward unused funds to the future or for retirement, an employee cannot take their HRA funds to a new employer.

Delivering the outcomes and experiences that matter most

Flexible Plan Design

Our HRA platform provides complete support for online enrollment, flexible plan designs, debit cards, claim integration, and more!

Automated Claim Process

OCA’s ClaimsExpress™ service streamlines the EOB retrieval and processing experience using automated technology.

Measurable Savings

We empower people to become better stewards of their healthcare dollars – helping people save more on healthcare, and helping employers bend medical trend.

Making HRAs Easier!

OCA’s ClaimsExpress™ service streamlines the EOB retrieval and processing experience using automated technology! With over 150 supported carriers, OCA offers competitive advantages through paperless Explanation of Benefits (EOBs) processing and electronic retrieval.

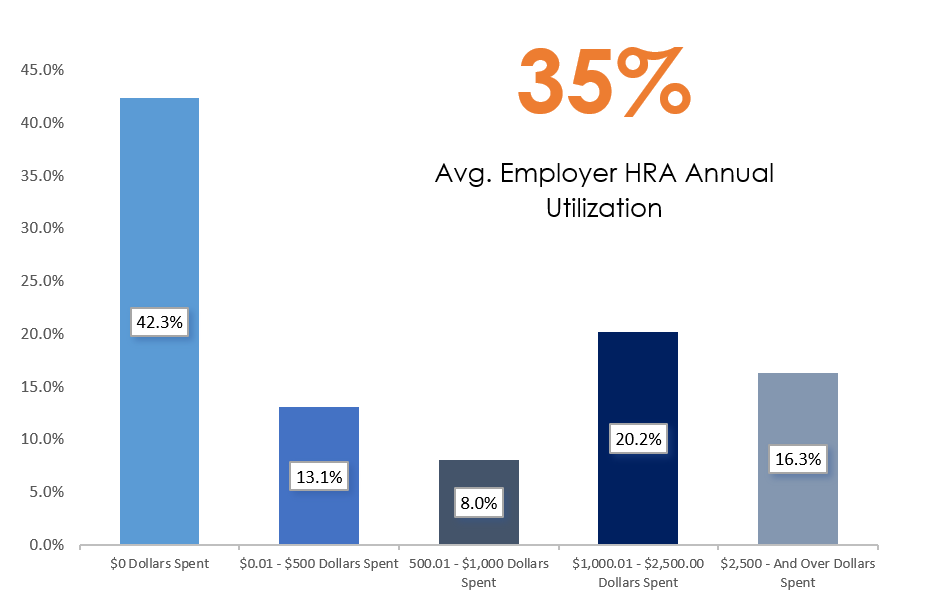

Learn MoreOCA’s HRA utilization last year was just under 35%.

The industry average is just over 40% HRA utilization. We believe this is due to our investment to employee education and compliant administration! With our HRA strategy, OCA provides employers with a win/win solution!

Health Reimbursement Arrangement FAQs

Are high-deductible health plans required in order to offer an HRA?

No. The HRA can be paired with any health plan; there are no limitations.

Can owners or partners participate in an HRA?

No. According to IRS guidelines, anyone with two-percent or more ownership in a schedule S corporation, LLC, LLP, PC, sole proprietorship, or partnership may not participate. C-corporation owners and their families are eligible to participate in HRA plans because they are considered to be W-2 common law employees.

Is there a tax benefit for my employees?

Yes. HRA funds are contributed to employees on a pre-tax basis; therefore, disbursements are not included when calculating taxable income. For this reason, employees can not claim an income tax deduction for an expense that has been reimbursed under the HRA.

What is the tax benefit for me as an employer?

Employers can deduct the amount of their contributions. Since the account is funded on a “notional” basis like a line of credit, the employer can take the deduction only when the amounts are actually paid out.

Do employers have to contribute the same amount to every employee’s HRA?

Yes, according to Federal regulations, employer contributions must be comparable, that is they must be in the same dollar amount for all employees with the same category of coverage. You can vary the level of contributions for full-time vs. part-time employees. There may be other variations around comparability. Consult your tax advisor for additional information.

Can the HRA allocation be set up on a 4-tier structure?

Yes. You may set up the HRA allocation for employee, employee+spouse, employee+child(ren), family, and more!

Does OCA’s HRA plan use debit cards?

Yes. Our compliant debit card provides consumers with immediate access to all their benefit accounts from one debit card. Eliminates confusion by automatically paying for eligible expenses from the right account based on the plan rules in place. Our enhanced auto-substantiation features allow our HRA programs to become extremely successful for employers and their employees.

Schedule a Demo with OCA

OCA’s HRA platform can help deliver the experience and business results you’re looking for.

Request Quote