ERISAExpress Wrap Documents

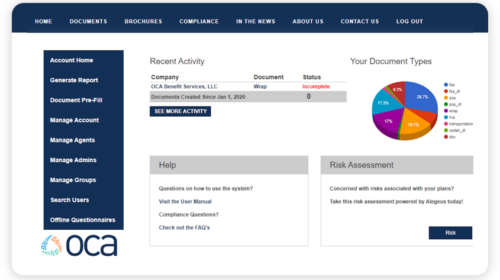

Wrap documents using OCA’s ERISAExpress™ platform, including both the required SPD and Plan document, are fully compliant and take minutes to create. The system also stores documents for seven years making it easy to find and manage current and past documents.

Fully-Customized

Competitive Pricing

Guaranteed Compliance

Wrap Documents Made Easy!

The Employee Retirement Income Security Act of 1974 (ERISA) requires group health plans to have a written plan document and a summary plan description (SPD). The SPD needs to be provided to all participants upon enrollment in the plan. Insurance carrier documents including the contract, policy or certificate booklet (collectively, the certificates) do not generally satisfy the ERISA requirement. Why don’t they? – Insurance companies are not required to create an ERISA-compliant SPD. While many carriers will provide Certificates and plan information, these typically do not contain the required language or provisions to satisfy ERISA. This can open the employer up to liability and fines.

Why Wrap Benefits?

Use One Document

Use one document to satisfy the ERISA SPD requirement and other disclosure requirements.

File one Form 5500

File one Form 5500 rather than a separate one for each benefit.

Stay Compliant

Failure to meet ERISA’s requirements can result in significant penalties imposed by the DOL.

Guaranteed Compliance

OCA’s team works with a nationally recognized law firm to have all questions, help tools, and documents reviewed. There is no need for you to watch for regulatory updates regarding your documents; OCA and its compliance team will monitor updates for you!

High Level Overview of Potential Penalties

Failure to meet ERISA’s requirements can result in significant penalties imposed by the DOL:

- Up to $110/day, per plan

- Failure-to-file penalties of up to $1,000 per day, per plan

- IRS penalties of $25 per day up to $15,000 per year, per plan

- Individual penalties for other breaches of fiduciary responsibilities

Wrap Document FAQs

Wrap Requirements

If an employer is subject to ERISA they’re required to:

Have a written plan document for each group and welfare benefit plan

Have a SPD for each group and welfare benefit plan

Keep their plan records for 6 years

File an IRS Form 5500 if they have more than 100 participants

Provide all of the ERISA required language

ERISA Required Language

A majority of carriers do not provide all of the above information in their benefit booklets or certificates.

Plan Name

Plan Number

Plan Year

Employer’s Tax ID

Name and Address for Plan’s legal agent

Named Fiduciaries

Procedures for amending/terminating the plan

Eligibility terms

Source of Plan contributions

Info on the responsibilities for the operation of the plan by ER, Carrier and TPA

Defined claims procedures

Subrogation Info (statement identifying situations that may result in loss or denial of benefits)

ERISA statement of participant’s rights

Plans Subject to ERISA

Fully insured group health plans (subject to ERISA and state insurance laws)

Self-funded group health plans (subject only to ERISA)

Dental plans

Vision plans

Group term life insurance plans

Accidental death and dismemberment insurance

Insured disability benefits

Prescription drug plans

Health flexible spending accounts

Medical expense reimbursement plans

Health reimbursement arrangements

Executive medical reimbursement plans

EAP plans

Wellness plans

Onsite clinic arrangements that are integrated with an employer’s group health plan

Schedule a Demo with OCA

OCA’s ERISAExpress service can help deliver the experience and business results you’re looking for.

Request a Demo