QTB Enhancements

Arriving this Fall 2021, QTB is excited to announce its partnership with OCA, a national Third-Party Administrator focused on providing flexible and compliant pre-tax benefits and COBRA administration.

QTB Enhances Client Experience with OCA Partnership

QTB will be transitioning to the OCA platform, which will offer a redesigned, next-generation benefit account experience – including a new and improved enrollment, claims and payroll processing, debit cards, virtual wallet, mobile app, and online portal experience!

OCA will deliver a smarter consumer-directed benefit account experience!

Delivering the Outcomes and Experiences that Matter Most

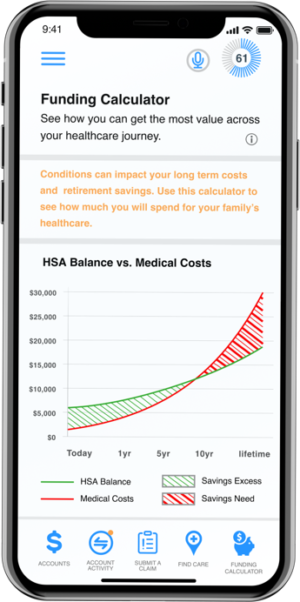

Personalized Guidance

We use data-driven insights and innovative AI technology to deliver truly personalized guidance – taking the guesswork out of healthcare spending and saving decisions.

Flawless Implementation and Conversion

High-quality conversion delivered on time, on budget and with minimal disruption to your clients.

Reliable & Secure Integrations

OCA’s integration of claims systems and member channels enable payers to position a single account experience.

Compliant Administration

We’ve also surrounded our firm with whom industry experts consider the preeminent legal counsel in our industry, Alston & Bird.

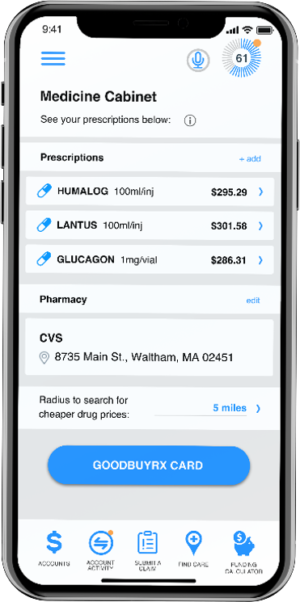

Simplified Client Experience

We remove complexity and simplify decision-making by connecting health and wealth resources in one intuitive, easy-to-navigate experience.

Rigorous Performance Measurement

Unmatched product innovation and investments, driven by client input, that enable your key business priorities.

A fast, easy and secure way for you to pay for eligible benefit account expenses.

OCA’s mobile pay is a solution that allows your employees to pay for eligible transit, parking, FSA, expenses digitally, through their mobile devices. This enhancement utilizes a tokenized card number that is never fully visible

Learn MoreGeneral QTB Transition FAQs

When will QTB clients be upgraded to OCA?

QTB will be communicating directly with each employer group informing them of their transition date to the OCA platform.

Will the employer administrative fees increase?

No. Clients will not have any fee changes under OCA. Clients will be upgraded to the enhanced platform free of charge! In addition, employers will now have access to additional services offered under the OCA benefit packages.

Will the employer need to complete new paperwork?

Yes. Prior to the employer transitioning to OCA, employers will receive an updated service agreement that will be signed by OCA and an authorized employer contact. In addition, employers will be asked to provide OCA with updated employer banking information (see Employer Banking FAQs).

Will employees need to complete new paperwork?

No. Plan participants will automatically be upgraded to OCA’s enhanced platform. No additional paperwork is required.

How will employer funding work?

OCA does not hold nor maintain any employer and/or employee funds. Employers will provide OCA with the employer owned/operated bank account. If/when a transaction (benefit debit card, direct deposit) occurs and the employee has funds available, OCA will automatically pull funds from the employer’s bank account typically within 2-3 business days.

How will claim reimbursements be processed?

If the employee did not use their benefit debit card or does not have their direct deposit information on file, OCA will issue a check off the authorized employer bank account. OCA can remit checks back to the employer for signature or directly to the employee or provider.

Will participants receive new debit cards?

Yes. Your participants will receive a new OCA debit card. The QTB Swipe-N-Save Card will be deactivated (shut down) 5 business days prior to the OCA transition date. Account balances will be moved from the QTB platform over to OCA’s platform and reflected on the OCA debit card.

When will employees receive their new debit card?

OCA will issue new debit cards roughly 1-2 weeks prior to the OCA transition date. The debit card will be mailed to the employee’s home address. However, employers will have the option to have cards shipped to the employer address if preferred. To change the default mailing address to the employer, please contact your QTB representative at qtb@oca125.com.

When will the existing QTB Swipe-N- Save debit card be deactivated?

The QTB Swipe-N-Save Card will be deactivated (shut down) 5 business days prior to the OCA transition date.

Will employers have access to an employer portal?

Yes. Employers will have access to OCA’s employer portal where they can view real time to payroll data, debit card transaction activity, claim reimbursements, participant account information, generate ad hoc reporting, and much more!

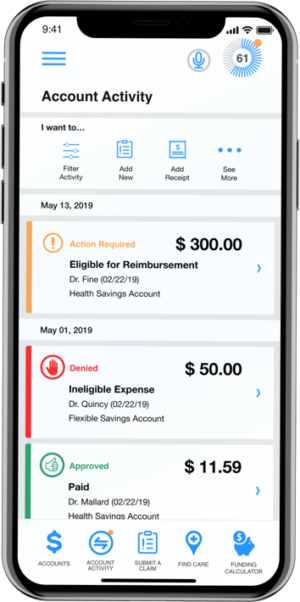

Will participants have access to a mobile app?

Yes. OCA’s free mobile app, “OCA Mobile,” is available to download on Apple and Android devices. The “OCA Mobile” app combines health and wealth in one location, providing users with a unique experience to help take the guesswork out of their benefit account spending and saving decisions. Participants can view account balances, manage debit cards, submit claims, and receive real time insights to give employees accurate, up-to-the-minute data the moment they need it.

Will there be a new phone and email client support line?

Yes. Employers, plan participants, and their dependents may contact the OCA client support team Monday through Friday, 9AM – 5PM EST. OCA’s client support line can be reached at 855-622-0777. Clients may also email service-related questions directly to service@oca125.com.

Does OCA offer an IVR system?

OCA offers a 24/7/365 Interactive Voice Recognition (IVR) system that provides self-service tools – by providing fast, accurate answers. Members can check all their benefit account balances, access recent claim activity, debit card activity, debit card activation and/or report as lost/stolen.