Patient-Centered Outcomes Research Institute (PCORI)

Understanding PCORI Fees

The Affordable Care Act imposed a fee on applicable self-insured health plans (i.e. HRA plans) to help fund the Patient-Centered Outcomes Research Institute (PCORI). As a result, the PCORI fee, which is to be reported only once a year on the second quarter Form 720, is now due again by July 31, 2025. As in the past, OCA has already taken steps to calculate the PCORI fee for our clients.

Next Steps

OCA will be sending “client specific” emails to employers during the week of June 10th with their calculated PCORI fee amount. The affiliated broker contact(s) for each employer will be cc’d on the client communication. OCA clients will then be responsible for remitting Form 720 and paying the the PCORI fee by July 31, 2025.

In the interim, we have provided PCORI fee FAQs such as who is responsible to pay it, how much the fee is, how it is paid, and more!

What is the new PCORI fee?

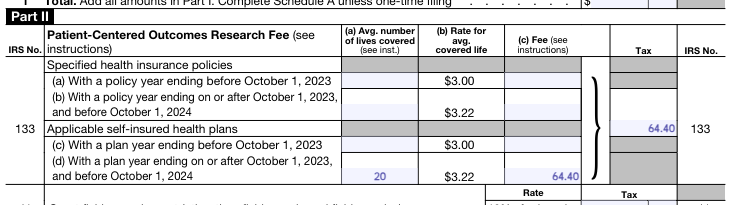

The IRS announced that the adjusted applicable amount for the Patient-Centered Outcomes Research Institute (PCORI) fee for policy or plan years ending on or after October 1, 2024, and before October 1, 2025, will be $3.47. Under an HRA, the amount of the PCORI fee is equal to the average number of enrolled employee lives (dependents are not included in the HRA calculation) covered during the policy year or plan year multiplied by the applicable dollar amount for the year. The below chart displays the plan end dates and PCORI rates that are due by July 31, 2025.

| HRA Plan Ending Date: | File return no later than: | Applicable rate: |

|---|---|---|

| Jan – 2024 | July 31, 2025 | $3.22 |

| Feb – 2024 | July 31, 2025 | $3.22 |

| March – 2024 | July 31, 2025 | $3.22 |

| April – 2024 | July 31, 2025 | $3.22 |

| May – 2024 | July 31, 2025 | $3.22 |

| June – 2024 | July 31, 2025 | $3.22 |

| July – 2024 | July 31, 2025 | $3.22 |

| Aug. – 2024 | July 31, 2025 | $3.22 |

| Sep – 2024 | July 31, 2025 | $3.22 |

| Oct – 2024 | July 31, 2025 | $3.47 |

| Nov – 2024 | July 31, 2025 | $3.47 |

| Dec – 2024 | July 31, 2025 | $3.47 |

Who Pays the PCORI Fee?

For HRAs, the plan sponsor (the employer) must pay the fee for each covered HRA employee (dependents and any other beneficiaries can be disregarded). OCA will be emailing HRA clients their PCORI fee calculation during the week of June 10th. Employers will then be responsible for paying the fee by July 31, 2025.

What form will employers use to report/pay the PCORI fee?

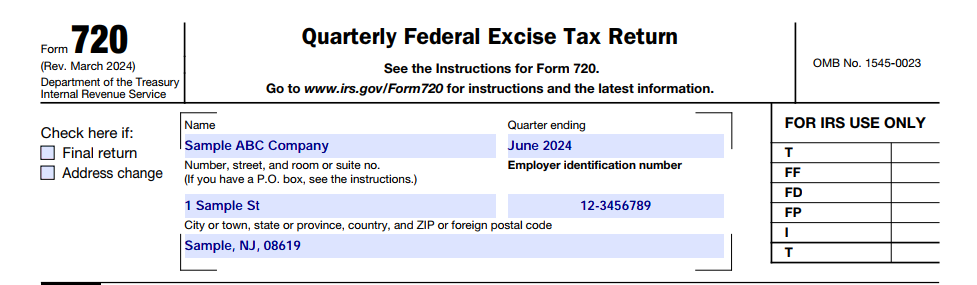

The fee is remitted using IRS Form 720, the Quarterly Federal Excise Tax Return. To view the latest Form 720 and instructions, click here.

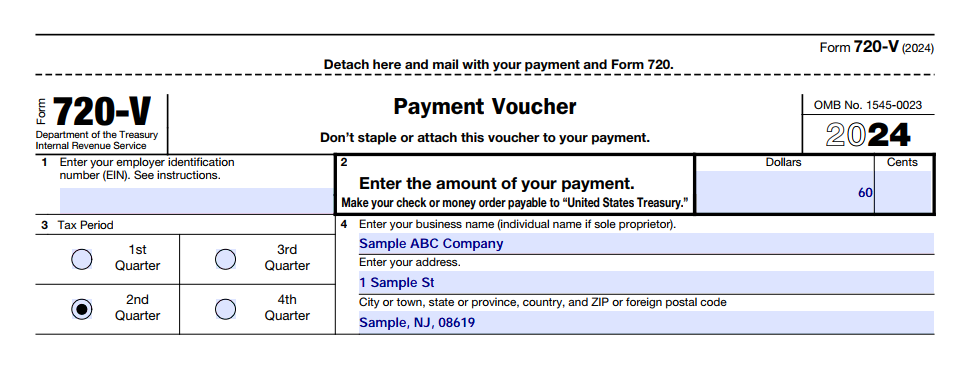

Electronic filing is available but not required. If paying by check employers will have to make a check payable to the “United States Treasury Department” and mail to the below address. For more information on electronically filling the PCORI fee, visit the IRS website here.

Mailing Address:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0009

When did the PCORI fee go into effect and when does it end?

The PCORI fee applies to specified health insurance policies with policy years ending after September 30, 2012, and before October 1, 2029, and applicable self-insured health plans with plan years ending after September 30, 2012, and before October 1, 2029.

For additional frequently asked questions, please visit the IRS PCORI FAQ page found here.

How to complete Form 720?

Step 1. Enter your Company name, address, EIN, and the quarter ending date (month and year).

Step 2: Complete Part II, line 133(c) or (d).

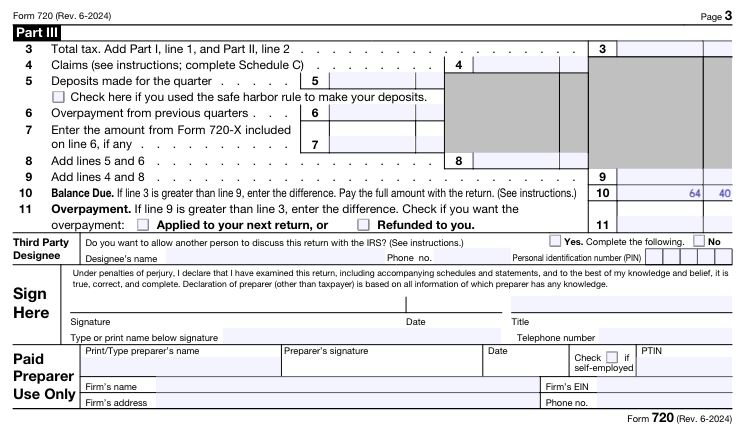

Step 3: Complete Part III lines 3 and 10, sign and date

Step 4: Complete Payment Voucher

The information provided in this section is for informational purposes only. It is recommended that you consult with a tax adviser or legal counsel to obtain professional advice and ensure proper compliance with the law.