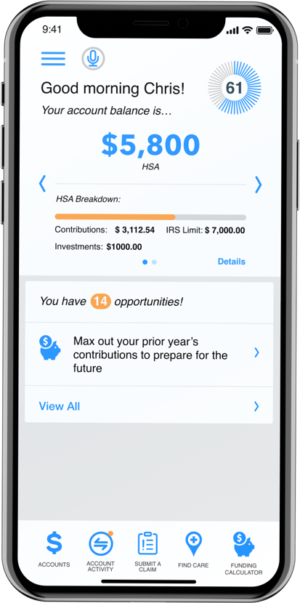

OCA’s Individual Health Savings Account (HSA)

Enroll in a health savings account (HSA) and start saving today!

An HSA is a personal savings account that allows you to set aside pre-tax dollars for current and future healthcare expenses for you and your dependents, even if they are not covered under your primary health plan. You are eligible to open an HSA if you are enrolled in an HSA-eligible high-deductible health plan.

Open AccountWe Deliver A Smarter HSA Account Experience

Download App

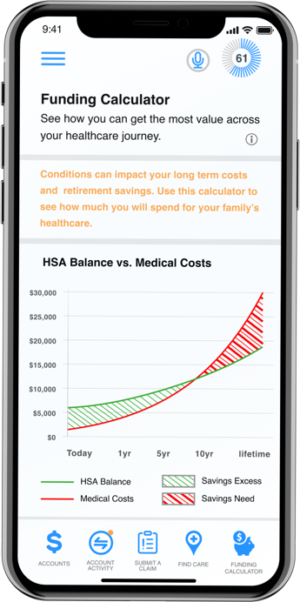

Using Investments to Grow Your HSA Dollars

One of the key benefits of an HSA is the ability for you as the accountholder to invest the dollars you contribute, potentially growing the value of your account over time. In addition to the benefit of having more dollars to pay for healthcare costs in the future, it may also be a great option for retirement savings either in place of or in addition to an IRA or 401(k).

Watch Investment Video

HSA Investments Made Easy

Key things you need to know as you begin:

- Minimum Balance is Required: With an HSA account balance over $1,000, you can establish an investment account. Any funds above this threshold can be invested in this account.

- Investments Are Self-Directed: You control which mutual funds to invest in.

- Industry Leading Investment Solution: Devenir is the advisor for the HSA investments, they have been a leader in HSA investments since they were first introduced.

- Online Account Management: You can manage your investments online via your HSA account.

Health Savings Account FAQs

Is an individual enrolled/entitled to Medicare HSA eligible?

An individual who is entitled to Medicare Is not HSA-Eligible. There’s more to it though. An individual can become entitled to Medicare benefits for three reasons: age, disability, or end-stage renal disease (ESRD). Entitlement to Medicare Part A is automatic for some individuals (i.e., a separate application is not required) because they have already applied for and are receiving Social Security or Railroad Retirement Act benefits. Other individuals must file an application in order to become entitled to Part A benefits. Note that mere eligibility for Medicare benefits (without enrollment) will not disqualify an individual from HSA eligibility.

The terms “eligible” and “entitled” are not synonymous under the Medicare regulations.* To be entitled to Medicare, an individual generally must be both eligible and enrolled. Medicare enrollment is automatic for some individuals (e.g., individuals who are receiving Social Security benefits); they simultaneously become eligible, enrolled, and entitled. Other individuals are eligible for Medicare but must file an application in order to be entitled to benefits (e.g., working individuals beyond age 65 who are eligible to receive Social Security benefits but who have not applied for them). For HSA purposes, Code §223(b)(7) states that an individual’s contribution limit becomes zero “for the first month such individual is entitled to benefits” under Medicare. IRS Notice 2004-50 and IRS Notice 2008-59 clarify that mere eligibility for Medicare does not make an individual ineligible to contribute to an HSA and that a Medicare-eligible individual who is not actually enrolled in Medicare Part A, Part B, Part D, or any other Medicare benefit may contribute to an HSA until the month that he or she is enrolled in Medicare.

In what ways can account holders contribute in the HSA?

You can make either pre-tax contributions, post-tax contributions, or a combination, as long as the combined total does not exceed IRS annual limits. Pre-tax contributions are made through payroll deduction. Post-tax contributions are made by depositing directly into to your HSA account. Post-tax contributions for a given year can be made up until the due date of your tax return for that year.

Can I contribute to my HSA while on COBRA?

The answer depends on the type of insurance coverage you have while on COBRA. As long as you are enrolled in a qualified high deductible health plan, you can make contributions. That is one of the stipulations for opening and contributing to an HSA.