Your Benefits. Our Technology. Your Way.

Flexible and compliant pre-tax benefits and COBRA administration backed by industry-leading support.

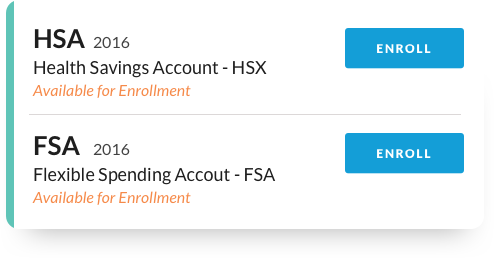

All of Your Benefits in One Place

Bring all of your benefits into one fully-integrated, automated, compliant system. It’s the smartest and easiest benefits administration solution for forward-looking businesses.

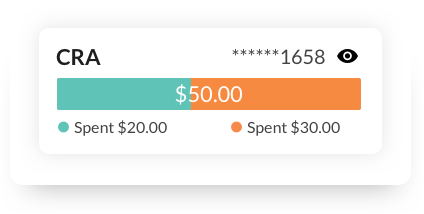

Accurate, Real-Time Reporting

We remove complexity and simplify decision-making by connecting health and wealth resources in one intuitive, easy-to-navigate experience.

Easy Integration. Fully Customizable.

Fully brand-able and configurable, with robust integration. Instantly integrate with over 150 of the most-used payroll, carrier, and benefits administration systems.

Built-in Debit Card Compliance

Multi-purse debit links multiple benefit accounts to a single card. Innovative auto-substantiate features built within our benefits system. Reduce manual approvals and reduce paperwork.

Over 4,000 Large and Small Businesses Trust OCA to Manage their Pre-tax Benefits and COBRA.

Client ReviewsIRS Announces 2024 FSA & Commuter Contributions Limits

The IRS has announced the 2024 contribution limits for Health FSAs and Commuter benefits. These changes…

Read More

2024 HSA Contribution Limits

Health Savings Account IRS Announces 2024 Adjustments for Qualified HDHPs and HSA Contributions The…

Read More

OCA Launches HSA High-Yield Interest Option

New High-Yield Interest Option for HSA Participants We are excited to launch a new High-Yield interest…

Read More